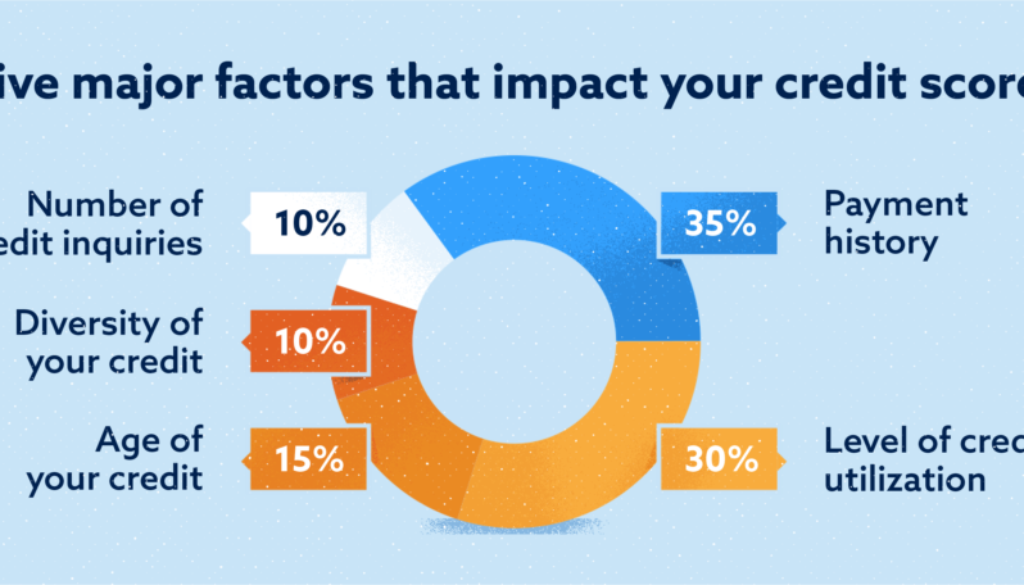

Five Key Factors That Affect Your Credit Score

Your credit score is one of the most important financial metrics in your life. It determines your ability to get loans, credit cards, mortgages, and even affects job applications or rental approvals. Understanding what impacts your credit score can help you make better financial decisions. Here are the five key factors that influence your credit score and how you can improve them.

1. Payment History (35%)

Payment history is the most crucial factor in determining your credit score. Lenders want to know if you can reliably make payments on time. Missing a payment, even by a few days, can negatively impact your credit score.

How to Improve:

- Set up automatic payments or reminders for your bills.

- Pay at least the minimum amount due if you cannot pay in full.

- If you’ve missed payments, get current and stay current.

2. Credit Utilization (30%)

Credit utilization refers to how much of your available credit you are using. If you max out your credit cards frequently, it signals financial stress to lenders.

How to Improve:

- Keep your credit utilization below 30%.

- Pay off credit card balances as soon as possible.

- Request a credit limit increase (but don’t use it all).

3. Length of Credit History (15%)

The longer your credit history, the better. Lenders prefer borrowers with a long track record of responsible credit use.

How to Improve:

- Keep your old credit accounts open, even if you don’t use them.

- Avoid closing old credit cards unnecessarily.

- Be patient; building credit history takes time.

4. Credit Mix (10%)

Lenders like to see a mix of different types of credit, such as credit cards, auto loans, mortgages, and personal loans.

How to Improve:

- Have a mix of credit accounts (revolving credit and installment loans).

- Avoid opening too many new accounts at once.

5. New Credit Inquiries (10%)

Each time you apply for a new credit account, a hard inquiry is recorded on your credit report. Too many inquiries can lower your score.

How to Improve:

- Only apply for credit when necessary.

- Space out new credit applications.

- Check if you qualify for loans using pre-qualification, which doesn’t impact your score.

Conclusion

Your credit score is a critical component of your financial life. By understanding these five factors and making small, consistent improvements, you can build and maintain a strong credit profile. Always monitor your credit report, practice good financial habits, and seek professional help if needed.

Let me know if you need any edits or additional images! 🚀